Applying for Financial Subsidies under Preferential Individual Income Tax (IIT) Policies in Guangdong-Hong Kong-Macao Greater Bay Area will be accepted from July 1st. To figure out how Overseas Talents can search and obtain their IIT tax records through “Tax E-check of Talent in Guangdong-Hong Kong-Macao Greater Bay Area”system, look over here!

Operating Steps

step 1

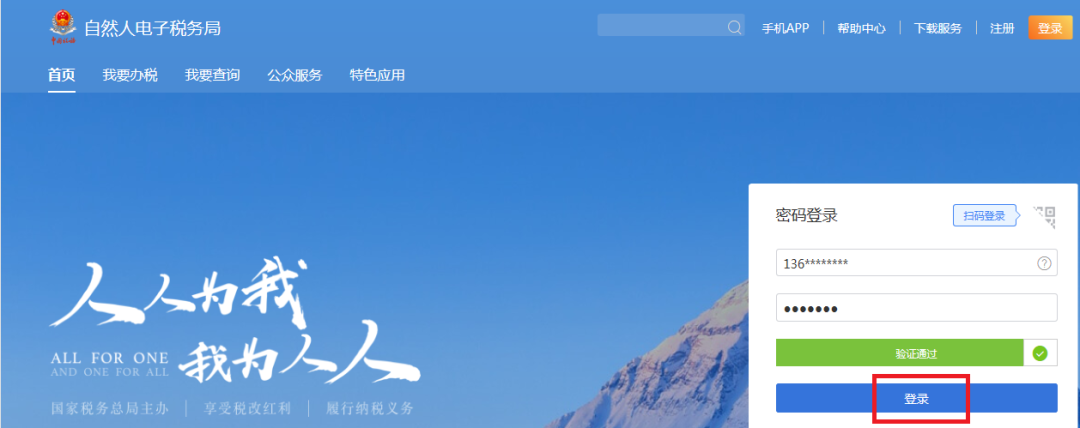

Log into the Natural Person Electronic Taxation Bureau system by accessing the following official website:

https://etax.chinatax.gov.cn/

step 2

After signing up an account and completing identity verification, choose “log in with a password” or “log in with a QR code”.

Log in with a password - Enter your mobile number/ID number and password, drag the slider to complete the verification and click the “Sign in” button.

Log in with a QR code-Open the Individual Income Tax application in the mobile phone and scan the QR code to log in.

step 3

Click “Featured Application” button and choose“Guangdong Province” after logging in your account. “Tax E-check of Talent in Guangdong-Hong Kong-Macao Greater Bay Area” could be found on this page. Click this button to access the Tax E-Check system.

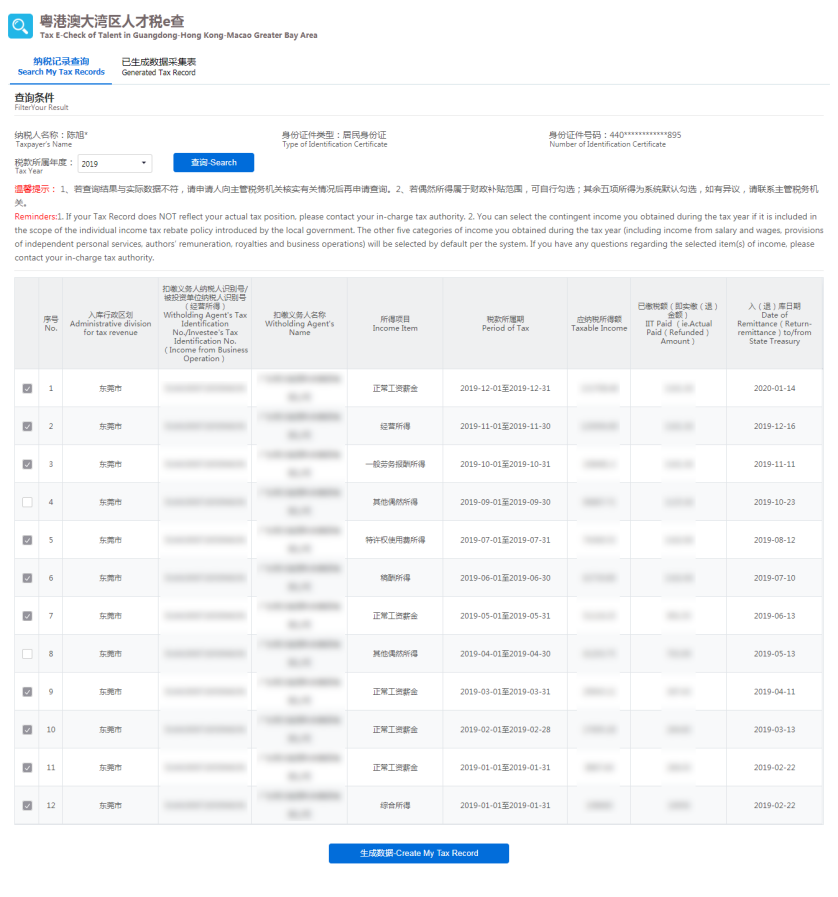

step 4

Go to Search My Tax Record and check your basic information (including Taxpayer’s Name , Type of Identity Certificate, Number of Identity Certificate and Tax Year). Choose “Tax Year” and click the Search button to obtain taxpayer’s income and tax record.

Note: You can select the contingent income you obtained during the tax year if it is included in the scope of the individual income tax rebate policy introduced by the local government. The other five categories of income you obtained during the tax year (including income from salary and wages, provisions of independent personal services, authors’ remuneration, royalties and business operations) will be selected by default. If you have any questions regarding the selected item(s) of income, please contact your in-charge tax authority.

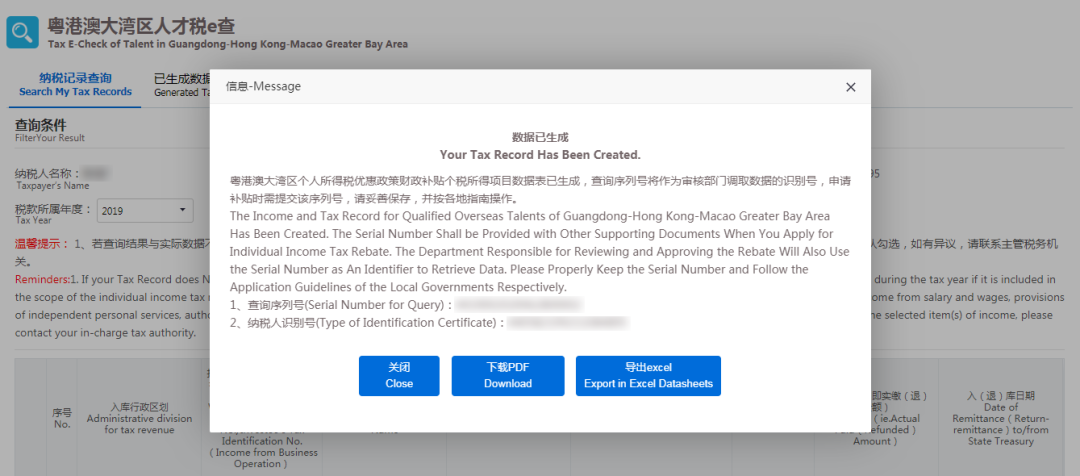

step 5

Click the Create My Tax Record button at the bottom of the record data. A reminder “Please verify your Tax record.” will pop up. Click “Yes, I have verified my Tax Record.” and then provide the information needed in the application of the tax record. Click “No.” and the system goes back to the page of the record data.

step 6

After obtaining your Tax record, choose Download in PDF Format or Export in Excel Datasheets. Click the Close button if you don’t need to download the record.

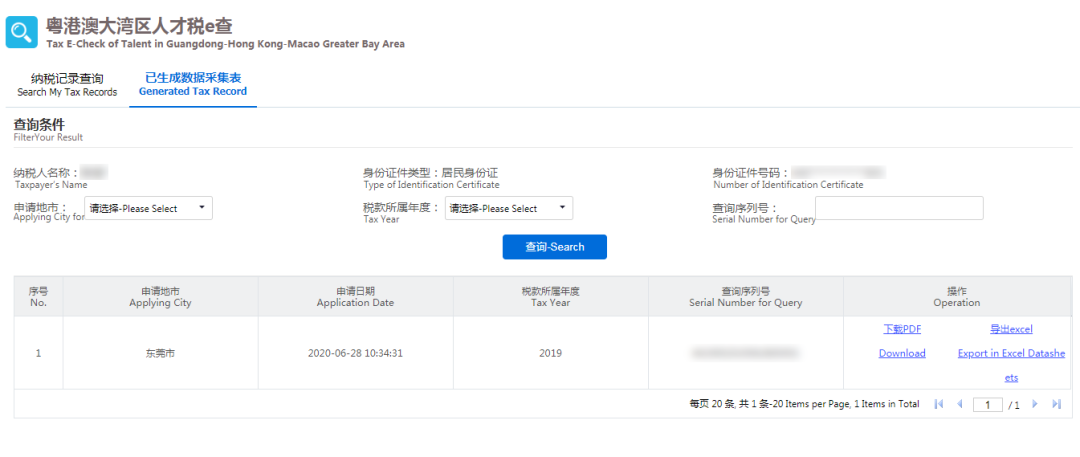

step 7

You can find the generated data in Generated Tax Record Module. Click Download in PDF Format or Export in Excel Datasheets to download your E-Tax record.

Source: Guangdong Provincial Tax Service, State Taxation Administration